What happened:

New US jobless claims for the week ending April 3 came in at 6.6 million, which brings the total since March to nearly 17 million. Most economists predict that we should not expect unemployment numbers to improve dramatically as the economy comes out of lockdown.

The Federal Reserve released another $2.3 trillion package, which is aimed at delivering credit to small business and municipalities as well as expanding its support to the corporate debt market for high yield bonds. In a quest to save “Main Street” it will buy up to $600 billion in debt with a backing of $75 billion from Treasury.

Eurozone finance ministers finally agreed on a €540 million stimulus package. It consists of countries being permitted to borrow up to €240 billion from the European Stability Mechanism (ESM). The EU will provide a further €100 billion to support unemployment schemes and the EIB provides a €75 billion guarantee scheme, whereby which companies can borrow up to €200 billion. As part of the compromise, the Netherlands withdrew its insistence on stringent criteria. The facility is, however, only available for pandemic-related expenditures, which means that countries cannot borrow at will. EU governments will have to approve the package next week.

Ministers also agreed on setting up a “temporary and targeted” recovery fund to aid economies in the post lockdown phase. There are neither an agreement or specifics at this time. Expect the Dutch to insist on conditions. The North-South disagreement on jointly issued common debt is also still prevalent.

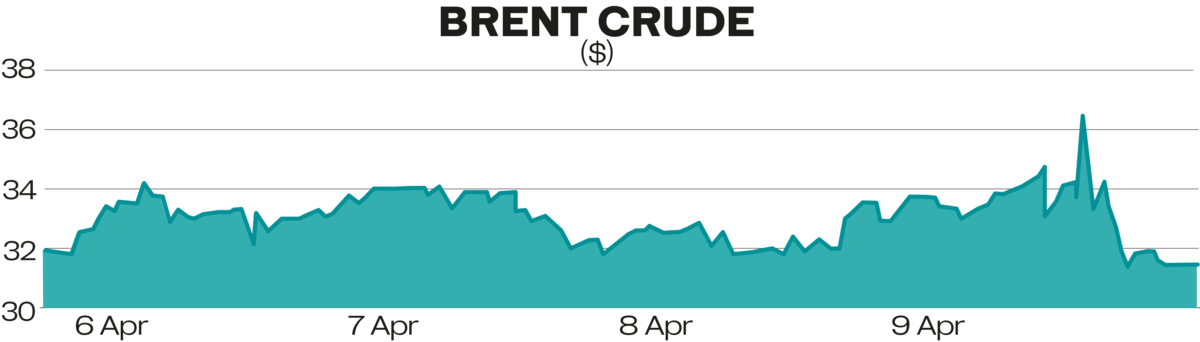

OPEC+ agreed in principle on a 10 million barrels per day (bpd) cut with both Russia and Saudi Arabia limiting their production to 8.5 million bpd. The cut would go through May 2020, be reduced to 8 million bpd through December and go to 6 million bpd from Jan. 1, 2021 to April 30, 2022.

While the deal stood in principle, Mexico threw a last minute wobbly, refusing to reduce its production by 400,000 bpd — insisting on a 100,000 bpd cut instead. This will probably not hinder the deal, but may get Mexico expelled from the OPEC+ framework. Brent fell some 11 percent on the news, as expectations of a 10 million bpd cut had been firmly baked into the price. It was down 4.1 percent on the day.

All eyes will be on Friday’s meeting of G20 energy ministers. OPEC will see how much other G20 oil-producing countries namely Canada, Brazil and the US are willing to contribute.

Why it happened:

The US Fed’s package comes in light of the country’s highest monthly rise of unemployment in history. It raises however two questions: Firstly, does the US government have systems in place to efficiently deliver the loans to small businesses and jobless support? Secondly, what are the inherent dangers of central banks supporting high-yield corporate debt, which has historically been the culprit behind financial crisis?

he eurozone package had to pass, because the discord put the very existence of “Project Europe” into peril. Countries can now borrow up to 2 percent of GDP with reasonable covenants. €540 billion will not be enough in the face of the economic havoc the pandemic caused across Europe. Economies will also recover at different speed, with the southern European economies, which rely heavily on tourism and have already high unemployment rates, displaying slower growth than their Northern counterparts.

Where we go from here:

The virtual meeting of the G20 energy ministers on Friday will be crucial in assuring that the OPEC+ deal stands. Both Russia and KSA expect other major oil producers to share in the pain, which is difficult for the US with its free market economy and lack of mechanisms to sanction production other than the Texas Railroad Commission.

The question behind any deal remains, how big cuts have to be to have a sustained impact? Global demand has gone down anywhere between 20 – 35 million bpd if not more since the outbreak of the crisis. The world is simply running out of storage capacity as countries have replenished their strategic reserves. If nothing else, lack of storage will result in falling production. In the US pipeline companies have begun to ask oil producers to limit throughput, which is unheard of.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairman and CEO of business consultancy Meyer Resources.Twitter: @MeyerResources