RIYADH: Three new hotel management agreements were inked with international hotel brands to operate resorts in the first phase of development at the Red Sea destination, The Red Sea Development Co. confirmed on Tuesday.

The announcement was made at the Future Hospitality Summit in Riyadh.

These hotels include Ritz-Carlton Reserve and Miraval hotels — the first to operate in the Middle East — and Rosewood, a global luxury hospitality company.

“This announcement demonstrates industry confidence in The Red Sea Project, with a total of 12 hospitality brands now confirmed, and signifies a growing appetite from global leaders to participate in the expansion of the Saudi tourism market. With two brands now entering the region for the first time, I believe the future of tourism in the Kingdom is bright,” said John Pagano, CEO at TRSDC.

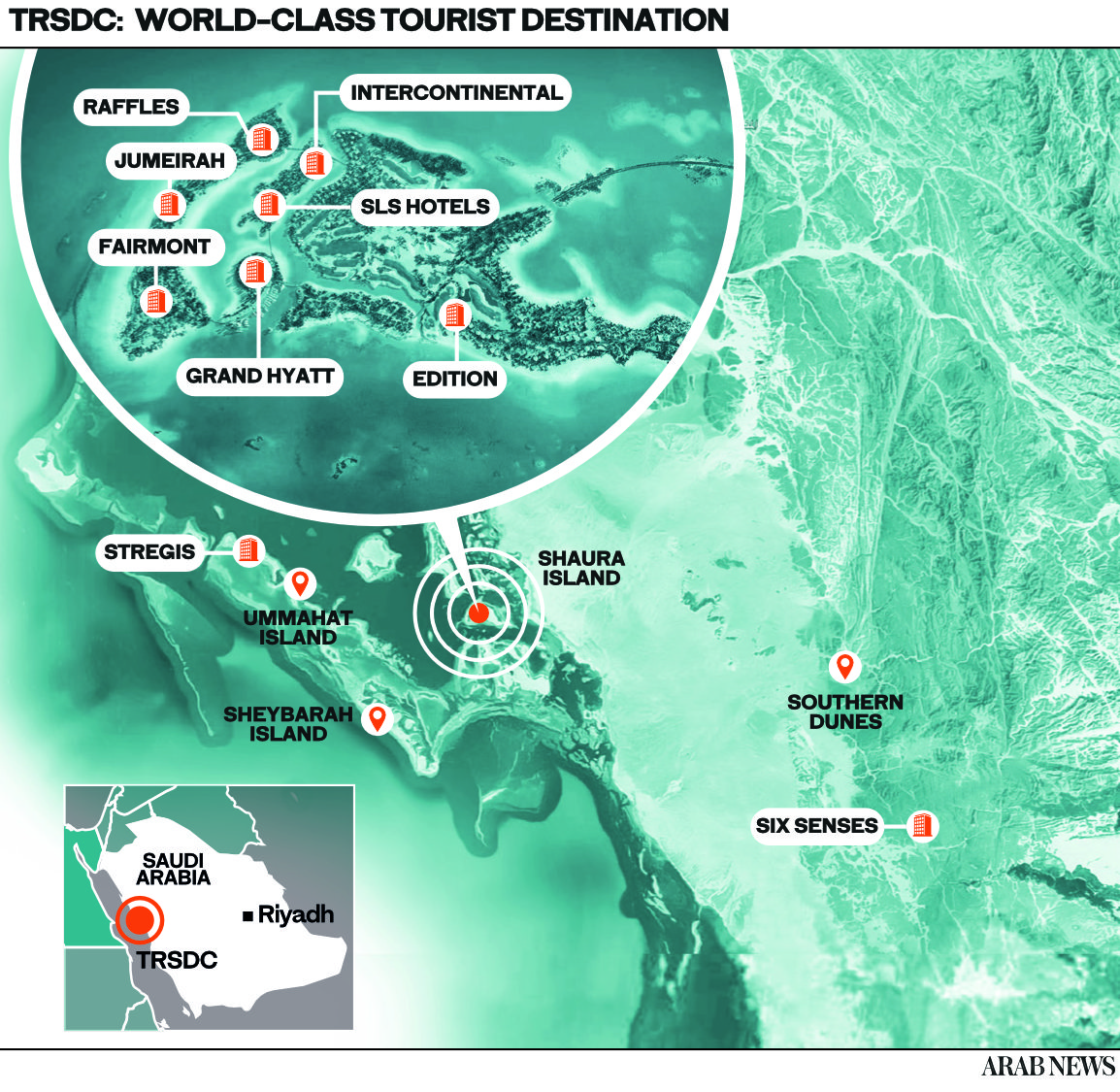

Upon completion in 2030, the project will comprise 50 resorts, offering up to 8,000 hotel rooms and more than 1,000 residential properties across 22 islands and six inland sites. (Supplied)

Ritz-Carlton Reserve is situated at the destination’s idyllic Ummahat Islands, while Miraval and Rosewood are located on Shura Island, the main hub for the resort. The new collection of hospitality brands collectively features nearly 500 hotel keys of the total 3,000 planned for Phase 1.

“Together with our collection of globally recognized and respected partners, we are excited to play our part in opening up this unique and undiscovered part of the world, setting new benchmarks for sustainable development along the way,” Pagano said.

A top executive from Marriott International also shared his thoughts with Arab News about the new deal.

“Nujuma, a Ritz-Carlton Reserve will offer a highly personalized leisure experience that blends intuitive and heartfelt service with stunning natural beauty and indigenous design. The resort will be surrounded by unspoiled natural beauty and designed to blend seamlessly with the environment,” Jerome Briet, chief development officer, Europe, Middle East & Africa, Marriott International told Arab News.

He added: “We will work closely together with The Red Sea team to promote the overall destination, as well as Nujuma, which will be a destination in itself. This is also where the strength of Marriott’s distribution system, our channels and partners will play a key role. When it opens, the resort will also have access to a network of over 160 million members as part of our loyalty program, Marriott Bonvoy, which Ritz-Carlton Reserve recently joined.”

For his part, Ludwig Bouldoukian, regional vice president, development, Middle East and Africa at Hyatt Hotels Corporation, talked about the promising future of Saudi Arabia’s Red Sea.

“Miraval The Red Sea will join Grand Hyatt The Red Sea as the second Hyatt hotel slated to open within the first phase of the Red Sea Development Project. It is a great source of pride for Hyatt to play such a central role in this project and be able to collaborate with owners who share our values and ambitions. We look forward to introducing guests to experience a new standard of luxury and wellness, synonymous to the Miraval brand, where the focus is on mindfulness and creating balance. We have great confidence in the success of this property that will be a unique addition to The Red Sea Project,” Bouldoukian told Arab News.

We will work closely together with The Red Sea team to promote the overall destination.

Jerome Briet, Marriott International

He added: “Saudi Arabia has become a thriving hub for global business, arts and culture, and pioneering hospitality experiences. This ever-evolving destination continues to represent an important growth market for Hyatt, reinforcing our continued commitment to intentional growth in places that matter most to guests, members, customers and owners.” He went on to say that as Hyatt continues to grow within the Kingdom, the company remains grounded in its purpose — to care for people so they can be their best.

“This promise is reflected in the elevated guest experience that will await guests to Miraval when the resort opens,” Bouldoukian said.

He stressed that with its untapped natural beauty, The Red Sea Project is the perfect location to bring the Miraval brand to the global stage.

Saudi Arabia has become a thriving hub for global business, arts and culture, and pioneering hospitality experiences.

Ludwig Bouldoukian, Hyatt Hotels Corporation

“This is the brand’s first property outside of the US. Expected to boast the largest spa and wellness facilities within The Red Sea Project, the property will usher in a new era of wellness tourism to the Kingdom; a sector that has already demonstrated great potential within the Middle East and is set to grow exponentially in the coming years,” he explained.

Bouldoukian added that Miraval The Red Sea will introduce the wellness brand’s signature mindfulness-based wellness practices to a new corner of the world, empowering guests with tools and inspiration to find balance and support their emotional and mental wellbeing.

“The Life in Balance Spa, which is expected to be the largest within the Red Sea destination, will be the heart of the property encompassing nearly 40,000 square feet (3,700 square meters) and 39 treatment rooms,” he informed.

The posh hotel companies join a line-up of globally renowned brands that have already confirmed they will operate at the Red Sea, including: EDITION Hotels and St Regis Hotels & Resorts, part of Marriott International; Fairmont Hotel & Resorts; Raffles Hotels & Resorts and SLS Hotels & Residences, part of global hospitality group Accor; Grand Hyatt, part of Hyatt Hotels Corporation; InterContinental Hotels & Resorts and Six Senses, part of IHG Hotels & Resorts; and Jumeirah Hotels & Resorts.

The statement explained that The Red Sea has already passed significant milestones and work is on track to welcome the first guests in early 2023 when the first hotels will open. Phase one, which includes 16 hotels in total, will complete by the end of 2023.

Upon completion in 2030, the project will comprise 50 resorts, offering up to 8,000 hotel rooms and more than 1,000 residential properties across 22 islands and six inland sites. The destination will also include an international airport, luxury marinas, golf courses, entertainment, and leisure facilities.