RIYADH: Saudi Arabia signed over SR2 billion ($533 million) worth of agreements with African countries during a special conference in a significant boost to the Kingdom’s ties with the continent.

The deals covered energy, roads, and health, and will be financed through the Saudi Fund for Development.

The Saudi-Arab-African Economic Conference, held in Riyadh, also saw the signings of multiple memorandums of understanding, as well as the lifting by the Kingdom of a ban on red meat imports from South Africa.

As well as deals led by Saudi Arabia, the Arab Coordination Group – which is made up of various development funds from across the region, the Islamic Development Bank, and the Organization of the Petroleum Exporting Countries – also pledged $50 billion to aid development in Africa, to be delivered by 2030.

There was even the revelation that more was still to come, with Saudi Minister of Investment Khalid Al-Falih telling the event that the Kingdom’s Public Investment Fund is eyeing up deals in the continent.

“PIF is looking at Africa with great interest and I believe they will be in due course making some game-changing announcements about their intent to invest in Africa,” he said, adding that Ma’aden and PIF’s joint venture – announced in January – is going to “invest in the critical minerals in Africa.”

Al-Falih described the $75 billion of Saudi investment already deployed in Africa as “only scratching the surface” given the great potential for more trade and economic support.

Echoing the minister’s notion, Ma’aden CEO Robert Wilt said the company is “serious” about exploration and are actively looking into 45 sites, with developments to be reported at the next Future Minerals Forum, scheduled for January.

The conference brought together representatives from the financial, trade, and government sectors to discuss improving ties between Saudi Arabia and Africa.

Saudi Finance Minister Mohammed Al-Jadaan hailed the significance of the many deals signed, and said: “Our partnership with African countries is strong and ever growing.

“In energy, education and agriculture amongst many others, the Kingdom considers Africa a strong investment destination and partner.”

Al-Jadaan also called for the creation of an additional seat for Africa on the Executive Board of the International Monetary Fund to strengthen the voice of the continent in global forums.

Announcing the Arab Coordination Group’s pledge, Chairman of the IsDB Mohammed Al- Jasser said: “Our conviction in the promise of Africa, its dynamic societies and its spirited youth, is unwavering.”

Speaking to Arab News on the sidelines of the forum, the Director General of the OPEC fund for development Abulhamid Al-Khalifa added: “Of course this comes with the support of all our partners, but also, the Kingdom of Saudi Arabia is providing the financial resources needed for these kinds of initiatives to be successful.”

Utilizing the platform of the forum, the OPEC Fund signed loan agreements with Rwanda to expand their water supply project, and with Benin to develop vocational training schools.

An MoU is signed between Saudi Arabia and Rwanda.

A number of memorandums of understanding were signed with a range of countries, including:

- Nigeria in the oil and gas sector.

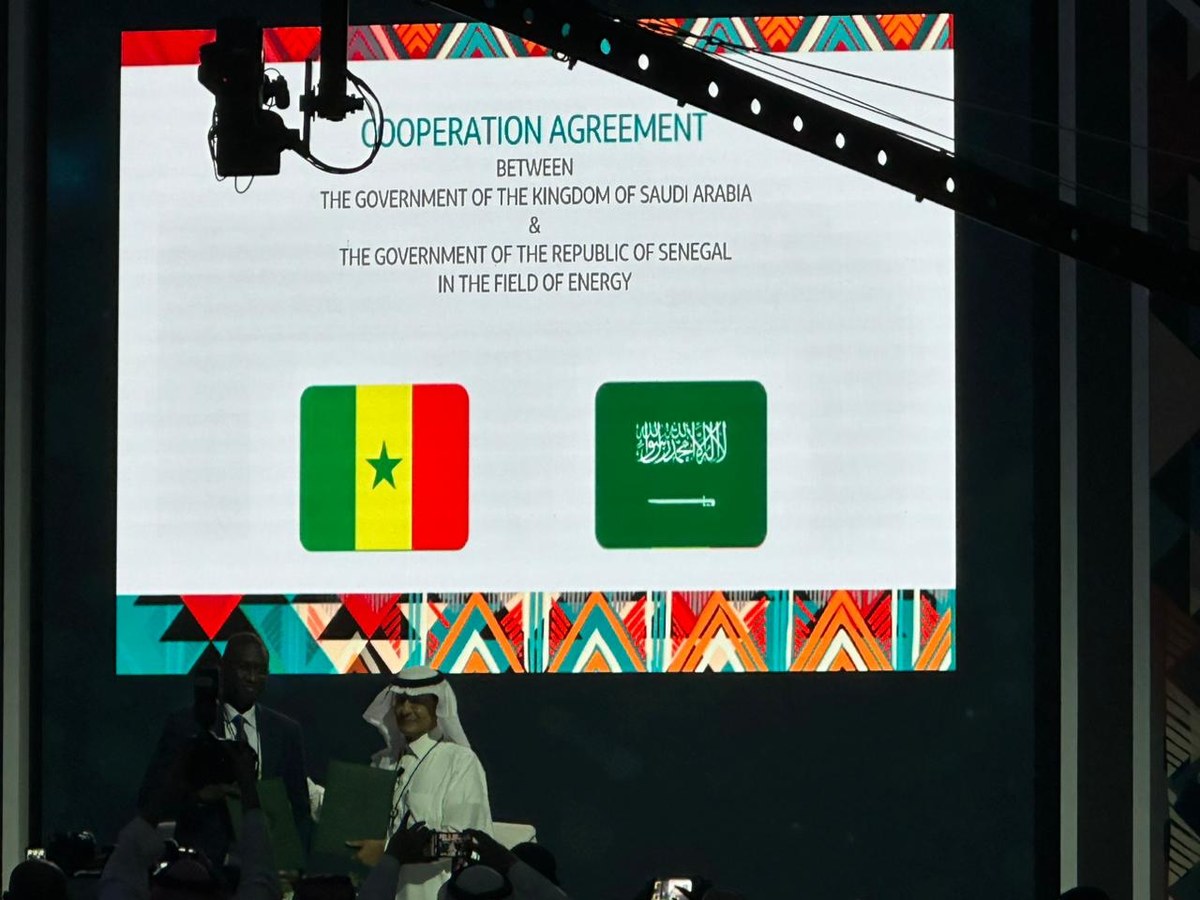

- Senegal, Ethiopia, and Chad respectively for cooperation in the field of energy.

- Egypt to establish “high level financial dialogue.”

- Gambia on the avoidance of double taxation of income and prevention of tax evasions.

- Rwanda to implement the oil sustainability program initiatives.

Rwanda’s Minister of Public Investment and Resource Mobilization Jeanine Munyeshuli suggested that more deals are on the horizon.

“We are happy with this agreement, and are going to be signing more to deepen our relationship and have long lasting relationships. For me, it was a very good one,” she said.

The Saudi Fund for Development reached developmental loan agreements with the following countries:

- Guinea, for a mother and child referral hospital – SR281.25 million.

- Malawi, for the construction and rehabilitation of the Manchogi – Makanjira road – SR75 million.

- Burkina Faso, for the Manga Regional Hospital – SR63.75 million.

- Burundi, for the rehabilitation of King Khalid University Hospital in Bujumbura – SR187.5 million.

- Sierra Leone, for the construction and equipment of Riyadh Referral Hospital – SR187.5 million.

- Tanzania, for the Benako to Kyaka transmission line – SR28.7 million.

- Niger, for the construction of secondary schools for girls in several regions – SR100 million.

The signing of a cooperation agreement with Senegal.

Strengthening industrial, mining and commercial partnerships was one of the key areas of discussion at the conference, along with sustainable energy, food security, and investing in business development, infrastructure and human capital.

Trade between the Kingdom and Africa has witnessed remarkable growth during the past five years, according to the Saudi Press Agency, with non-oil exports to the continent increasing at an annual growth rate of 5.96 percent from 2018 to 2022, reaching SR31.94 billion.

Industrial and mining activities lead Saudi non-oil exports to Africa, with the chemicals and polymers sectors top, followed by packaging, building materials, and food products.

Imports from Africa came from a number of sectors, including precious metals and jewelry.

The conference also saw the signing of an agreement to lift the ban of red meat imports to Saudi Arabia from South Africa.

The decision to change the law had been agreed in 2022, when South African president Cyril Ramaphosa met with Crown Prince Mohammad bin Salman during his state visit to the Kingdom.

During the conference, this was realized as the Kingdom signed an agreement for technical requirements of importing cattle and goat meat, as well as their products, with South Africa.

The formalizing of the ban’s removal was signed by representatives of the Saudi Food and Drug Authority and South Africa’s Department and Trade Industry, overseen by the Kingdom’s investment minister.

Speaking to Arab News, South African Minister of Trade Ebrahim Patel – who also witnessed the signing – noted this is just the beginning of a budding trade relationship.

“I think we can unlock a lot more Saudi investment through three key means. One is we are exploring the idea of a joint fund where both governments put some money together that can unlock investment expansion projects,” the minister added.