BP and its partners on the project, Shell, ConocoPhillips and Chevron, will now enter the second phase of the Clair Ridge project, the development of a field west of the remote Scottish Shetland Islands.

A 12 percentage point tax hike earlier this year led to howls of protest from the oil industry and predictions of a big drop in investment and an acceleration in the recent decline in North Sea output.

Giving an upbeat assessment of its future production from the North Sea, BP said the investment it was making in this and three other projects would be the highest annual investment it had ever made in the UK North Sea.

“After some years of decline, we now see the potential to maintain our production from the North Sea at around 200,000-250,000 barrels of oil equivalent a day until 2030,” said BP chief executive Bob Dudley in a statement.

BP produced over twice this level at its high point, and before Thursday had not previously issued a North Sea production goal, a spokesman said.

North Sea production peaked in 1999 at around 6 million barrels of oil equivalent per day, and big oil companies have in recent years preferred to open up newer oil provinces with more potential.

However, BP chief executive Bob Dudley is under pressure from investors to show the company has growth opportunities, with shares at the level when the company’s doomed Gulf of Mexico well was capped, and the company has been aggressively promoting every new deal.

The investment in the Clair Ridge project could also go some way to help slow the rate of decline of North Sea output.

BP is only one player among many in the area, which is increasingly dominated by smaller companies. With oil services companies reporting strong demand across the board, Dudley’s output aim suggests some pessimistic predictions will now be avoided.

Oil & Gas UK had said British oil and gas output could fall to around 500,000 barrels of oil equivalent per day (boepd) by 2020.

“A confident outlook for the group (BP) from what is often considered a mature and declining region with limited upside or support for oil major portfolios,” said Santander analyst Jason Kenney.

Shares in BP were 2.1 percent lower at 403.3 pence at 1400 GMT, lagging the European oil and gas sector, which was down 1 percent.

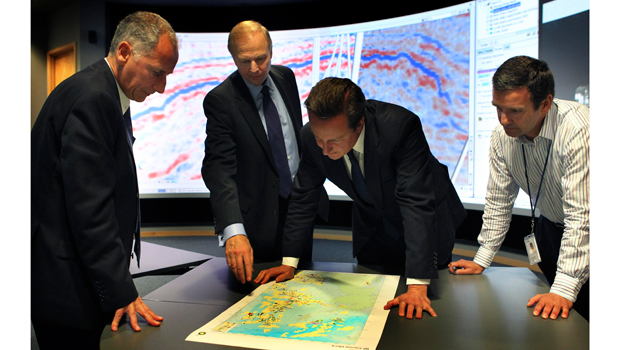

UK Prime Minister David Cameron, who visited BP’s Aberdeen offices earlier, welcomed the project and said the investment would provide a “massive boost for jobs and growth” in the country.

Unemployment in Britain is at its highest level in 17 years as the economy teeters on the brink of recession

“It shows the confidence that there is to invest in the North Sea,” said Cameron, who was due to take part in talks with oil and gas firms on Thursday.

On the matter of taxes on the industry, Cameron gave hope that some further allowances may be made for marginal fields.

“Some discussions need to take place about how you put in place the things that will make a difference at the margin,” he said.

Environmental group Greenpeace criticized the government for sanctioning the project, arguing that it contradicted the coalition’s promise to protect the environment.

A parliamentary report in January highlighted doubts about the ability of oil spill response equipment to function in the harsh environment west of the Shetland Islands.