The week that was:

The IMF and the World Bank held their annual meetings virtually. G20 finance ministers and the multilateral lenders agreed to extend the Debt Service Suspension Initiative (DSSI) through June 2021, suspending the payment of interest and principal. The world’s 79 poorest countries are eligible to join the DSSI.

A second wave of the coronavirus disease (COVID-19) pandemic reaching Europe and the US and a lack of agreement on a US stimulus package has been affecting global markets.

US first-time jobless claims rose to 898,000 for the week ending Oct. 10, increasing by 53,000 compared with the preceding week and stubbornly remaining above 800,000 since March when the pandemic first hit the US.

In Saudi Arabia, the National Commercial Bank announced that it would acquire SAMBA Financial Group for $15.4 billion, creating the GCC’s third-largest lender with combined assets of $220 billion.

European car sales grew for the first time in 9 months.

The earnings season kicked off with the largest US banks reporting Q3 results.

Daimler reported preliminary earnings coming in with stronger-than-expected profits at €3.07 billion ($3.6 billion) versus an estimate of €1.61 billion. The company is focussing on earnings to build the financial war chest necessary to realign production toward EVs.

In Saudi Arabia, United Electronics reported blockbuster Q3 revenues earnings worth SR1.23 billion ($328 million) and a profit of SR53.2 million. The company benefited from a reallocation of household funds from travel and leisure to electronics and retail.

Focus:

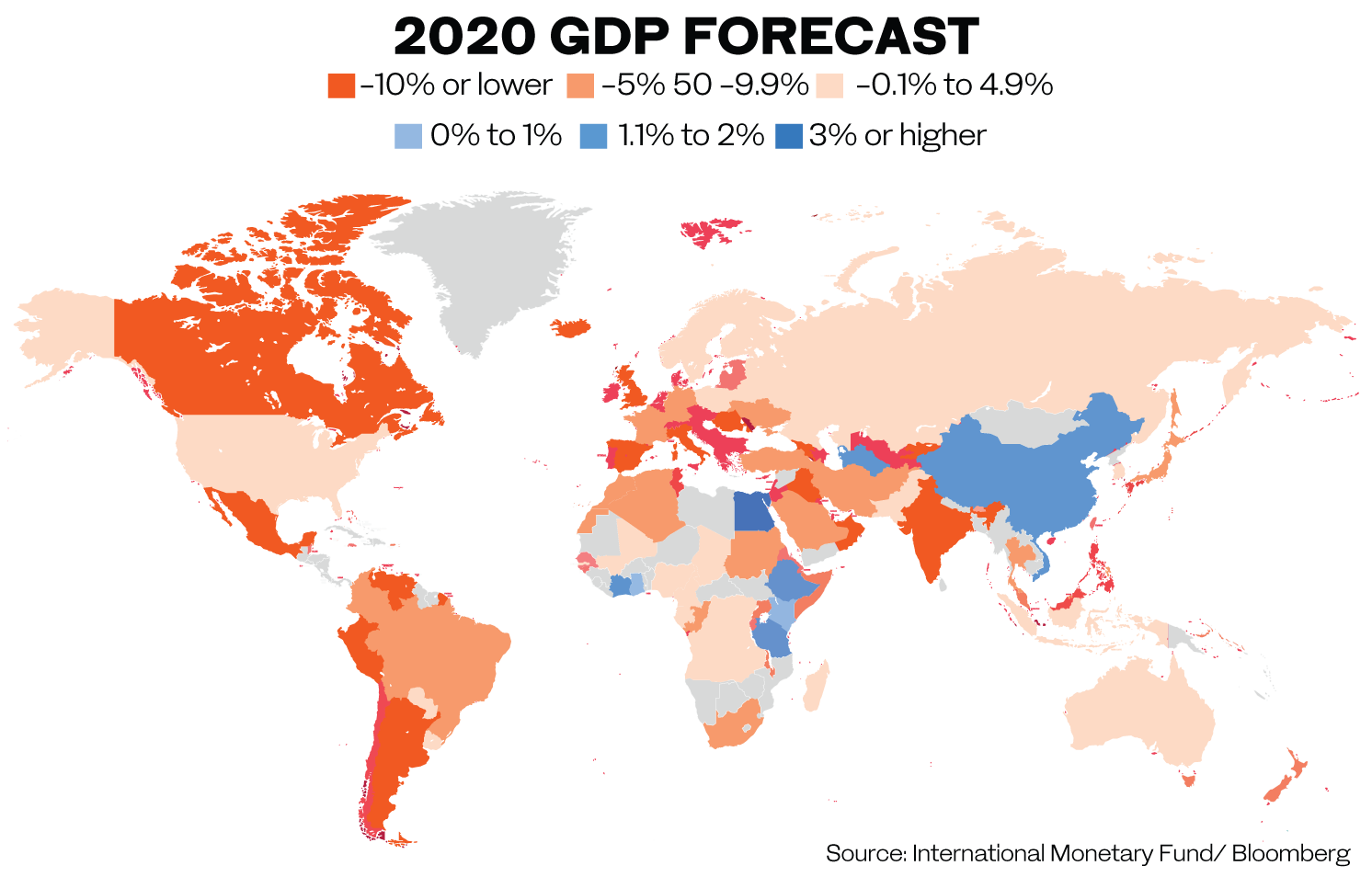

The IMF slightly improved its global economic outlook for 2020, but also forecasted a slower recovery in 2021, highlighting growing inequalities. In 2020 Global GDP is set to decline by 4.4 percent compared to 5.2 percent predicted in June. 2021 growth is forecast at 5.2 percent compared to 5.4 percent in June. The fund’s Chief Economist Gita Gopinath warned that the road to recovery would be long, uneven and highly uncertain. China will grow by 1.9 percent this year, but pre-pandemic growth levels will not return until 2022 at the earliest.

The US will contract by 4.3 percent this year, the eurozone by 8.3 percent and Latin America by 10.3 percent.

The picture is uneven. Frontline economies are particularly hard hit. Manufacturing is recovering nicely, while the high contact service sector like tourism, hospitality and travel may take until 2025 to reach pre-pandemic levels. According to Gopinath, this is the biggest recession since the Great Depression and the cost to the global economy so far amounted to $28 trillion.

These forecasts were drawn up before the recent lockdowns in Europe and the worsening situation in the US. Where we will go from here depends greatly on the progress of combatting the pandemic. The halting of vaccine trials by Johnson and Johnson and Ely Lilly indicate that the road to finding remedies may not be that smooth.

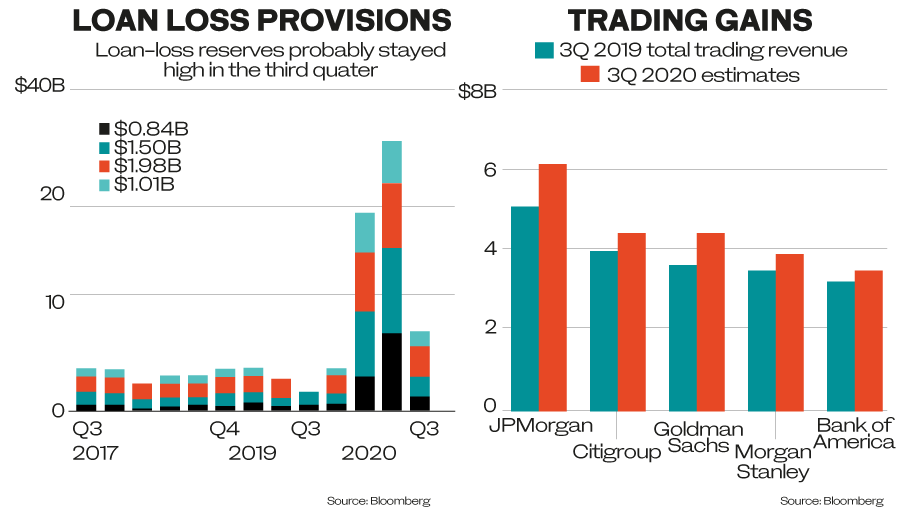

Morgan Stanley, JP Morgan Chase, Goldman Sachs, Citigroup, Bank of America and Wells Fargo reported Q3 earnings. The first three fared best, the second two provided the middle ground, and Wells Fargo continued to disappoint. Overall loan loss provisions increased compared to a year ago, the pace of additional loan loss provisions slowing compared to H1. This is a reflection of fewer defaults than anticipated through Q3, but uncertainty over the path of the economy.

The banks with strong trading operations were able to benefit from the increased trading activities due to market volatility and stock markets recovering from their March lows.

Morgan Stanley fared particularly well with profits jumping 25 percent. Net income stood at $2.7 billion while revenues came in at $11.6 billion, 16 percent higher than a year ago, beating analysts’ expectations by $1 billion. The positive results were based on an uptick in sales and trading. Morgan Stanley surprised last week by acquiring investment manager Eaton Vance, augmenting its asset management capabilities. The bank reported $20 billion worth of acquisitions this year.

The Q3 profit of JP Morgan Chase stood at $2.44 billion, which equates to an EPS of $2.92 or 69 cents above Refinitiv estimates. Goldman Sachs’ Q3 profits were $3.62 billion or $9.68 per share, $4.11 above Refinitiv estimates.

Citigroup’s Q3 revenue came in at $17.3 billion or $1.40 per share. Bank of America’s Q3 profits slumped by 16 percent year-on-year, coming in at $4.9 billion, or an EPS of 51 cents, which is still 2 cents above estimates.

Wells Fargo’s revenues came in at $18.9 billion, net interest income fell by 19 percent year-on-year to $9.4 billion. EPS stood at 42 cents, 3 cents below Refinitiv estimates.

Where we go from here:

Jack Ma’s payment vehicle Ant Group has pushed its valuation target up to $280 billion, which could make it the world’s largest IPO when it is listed on the Hong Kong and Shanghai stock exchanges.

The Joint Ministerial Monitoring Committee of OPEC+ will meet on Monday to review compliance with their 7.7 million bpd production cuts. Meanwhile, the International Energy Agency forecasted that more supply — which could come on the market if OPEC+ sticks to its plan to reduce cuts to 5.8 million bpd in 2021 — would markedly slow the decline in bulging global inventories. A decision on the adjusting output cuts is not expected until late November early December.

The EU Aviation Safety Agency declared the Boeing 737 safe to fly. We may see the plane’s return to Europe’s skies within 2020.

UK Prime Minister Boris Johnson will decide on Friday whether to return to the negotiating table with the EU over a post-Brexit trade deal. During their Thursday summit, EU leaders did not give him a steer on how much they were willing to compromise.

US President Donald Trump is ready to lobby the Republican Party for a bigger stimulus package to reach a deal with Speaker of the House of Representatives Nancy Pelosi.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources