The week that was:

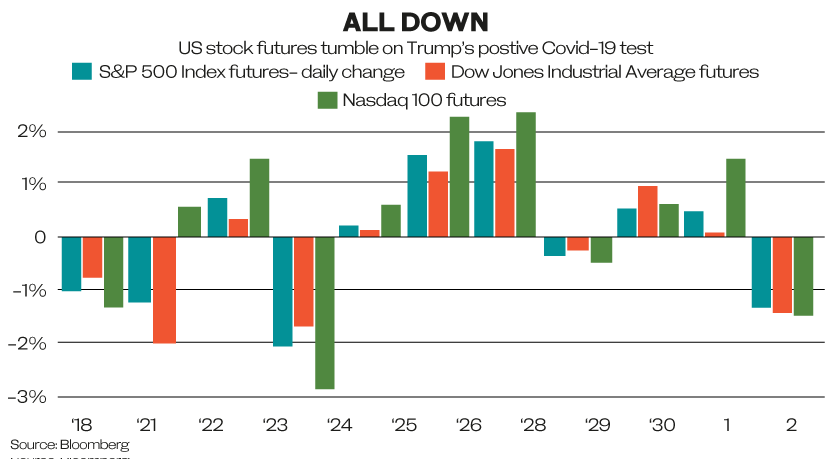

US President Donald Trump and his wife Melania contracted COVID-19. This had an immediate impact on US futures. Markets turned risk off. Some of the immediate market action was likely triggered by algorithms responding sharply to the headlines.

This is an unprecedented situation with the presidential election due on Nov. 3. Its effect on the presidential race remains unknown. The initial assessment of some analysts is that it will improve the odds for Democrat candidate Joe Biden.

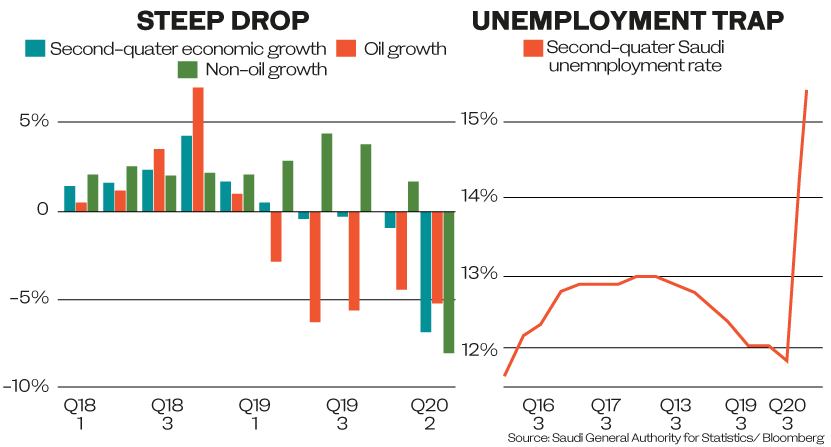

The Saudi economy contracted by 7 percent during the second quarter, with the non-oil sector shrinking by 8.2 percent and the oil sector by 5.3 percent. The non-oil private sector contracted by more than 10 percent, which is significant because it is usually the biggest contributor to jobs’ growth. The IMF predicts the Saudi economy will shrink by 6.8 percent this year and grow by 3.1 percent in 2021.

Unemployment hit record levels at 15.4 percent, despite the government supporting 60 percent of many wages. The Kingdom’s “youth bulge” will require the Saudi economy to generate around 150,000 jobs per annum. Crown Prince Mohammed bin Salman’s Vision 2020 program plays an integral part in achieving this goal. S&P affirmed KSA’s sovereign credit rating at A-/A-2 with a stable outlook.

The oil price fell for the second consecutive week amid the lukewarm economic outlook. At noon on Friday, Brent traded at $39.49 and WTI at $37.35 per barrel.

Shareholders voted to dissolve the UAE’s Arabtec Holding PJSC, putting 40,000 jobs at risk. The company and its subsidiaries racked up $216 million in losses during the first half of 2020. The Mubadala-backed group had 5 billion UAE dirhams ($1.4 billion) in receivables and 1.8 billion dirhams in debt. This is a sign of the difficulties the construction sector faces in the UAE and beyond amid shrinking GCC economies.

On Monday, Siemens Energy had a lacklustre start on the Frankfurt Stock Exchange. Shares initially slumped after its IPO valued the company’s equity at €16 billion ($18.8 billion), €5 billion lower than anticipated. This was the last puzzle in the strategy of outgoing CEO Joe Kaeser to unlock value in the conglomerate. The middling debut is an indication of how difficult it is for original equipment manufacturers to navigate energy transition, especially during an economic downturn.

The world’s third-largest equity market, the Tokyo Stock Exchange, resumed trading on Friday after an all-day outage due to technical glitches. This was the worst outage in its history and a sign of how dependent we have become on technology.

Focus:

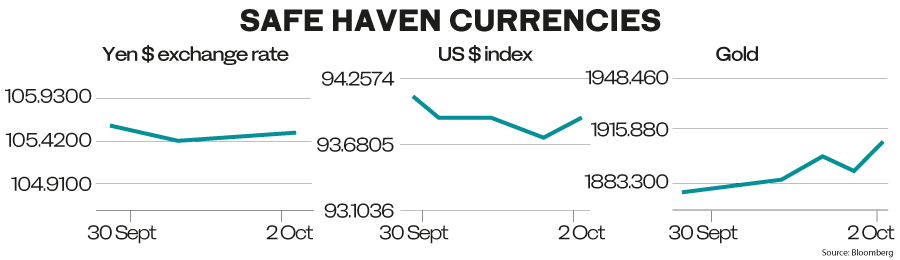

News that the US president had contracted coronavirus precipitated a flight to safe havens. The dollar, the yen and gold did particularly well. Volatility was up, with the VIX rising to 29, which was below last week’s spike.

The question of how these investment categories can keep investors whole remains: Gold may look attractive, while other safe havens such as government bonds yield little, with interest rates near or below zero.

The dollar may benefit in the short run. However, downward pressure will remain in the long term, with further fiscal packages to follow and interest rates remaining low amid the Fed’s dovish stance.

Trump’s predicament is bound to have an impact on the stimulus negotiations between Speaker of the House of Representatives Nancy Pelosi and US Treasury Secretary Steven Mnuchin, which have resumed in person for the first time since August.

The two positions are still miles apart, with Pelosi demanding $2.2 trillion (the bill for which has passed the Democratic-controlled House) and Mnuchin’s offer of $1.6 trillion. The Democrats want to leave unemployment benefits at $600 a month, while the Republicans want to scale them down to $400. The Republicans have upped their offer of support for state and local governments by $100 billion to $250 billion. Talks are set to continue. Meanwhile, on Thursday, the president signed a stop-gap funding bill to avert a government shutdown.

Unemployment was the big theme of the week across the globe as economies slowed markedly in Europe and the US.

The hold-up on a rescue package in the US puts jobs at risk: United Airlines and American announced plans to shed 32,000 employees. Some of the redundancies could be reversed with sufficient government stimulus. US banks have fired 70,000 workers since the start of the pandemic. This week Allstate and Goldman Sachs announced a further 3,800 to 4,000 job cuts. Disney is slashing 28,000 jobs, two thirds of which are part-time roles.

Bayer announced plans to cut costs by €1.5 billion, which is bound to result in job losses, while Shell said it will slash 9,000 jobs. In Europe, many more jobs are expected to be lost as furlough schemes are trimmed.

Winter is on the doorstep in the northern hemisphere, and with the pandemic showing no sign of abating in Europe, the US and elsewhere, the effect on job markets is likely to be negative.

On Thursday, US first-time jobless claims came in at 837,000 for the week ending Sept. 26. This is 36,000 better than the preceding week, although the metric has never fallen below the 800,000 mark since March.

September non-farm payroll rose by 661,000, which was below forecasts. The unemployment rate came down to 7.9 percent, which was above expectations. Labor participation stood at 61.4 percent. This marks a downshift in the economic recovery. The question is how companies will calibrate staffing needs for 2021.

Where we go from here:

The EU summit threatened sanctions against Belarus, demanding President Alexander Lukashenko end a campaign of repression and free all political prisoners. It also threatened to “keep all options and instruments at its disposal” regarding Turkey, while offering a “positive” political EU-Turkey agenda, which indicates a double-tracked approach.

The EU issued a letter of notice to the UK in response to the House of Commons having passed the Internal Market Bill, which reneges on parts of the withdrawal agreement. Sterling fell 0.7 percent on the news.

The last round of Brexit negotiations made little headway. UK Prime Minister Boris Johnson will intervene directly for the first time since June, and is scheduled to call EU Commission President Ursula von der Leyen on Saturday.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources