LONDON: In a U-turn, the British government is expected to ease visa rules for truck drivers to help fix supply-chain problems that have triggered long lines at gas stations and some shuttered pumps.

The government said late Friday it was “looking at temporary measures to avoid any immediate problems.” It said any action it took would be “very strictly time-limited.”

The haulage industry says the UK is short tens of thousands of truckers, due to a perfect storm of factors including the coronavirus pandemic, an aging workforce and an exodus of foreign workers following Britain’s departure from the European Union.

Post-Brexit immigration rules mean EU citizens can no longer live and work visa-free in Britain, as they could when the UK was a member of the trade bloc. Trucking companies have been urging the Conservative government to ease immigration rules so drivers can more easily be recruited from across Europe.

Britain’s farming and food processing industries, which are short of fruit-pickers and meat-packers, have made similar requests.

The government has resisted, saying British workers should be trained up to take the jobs. It has stressed that Britain is not short of fuel, but that has not stopped motorists forming lines at gas stations to fill up just in case.

Sporadic supply chains at supermarkets and other shops starting several weeks ago also were attributed to a lack of delivery drivers.

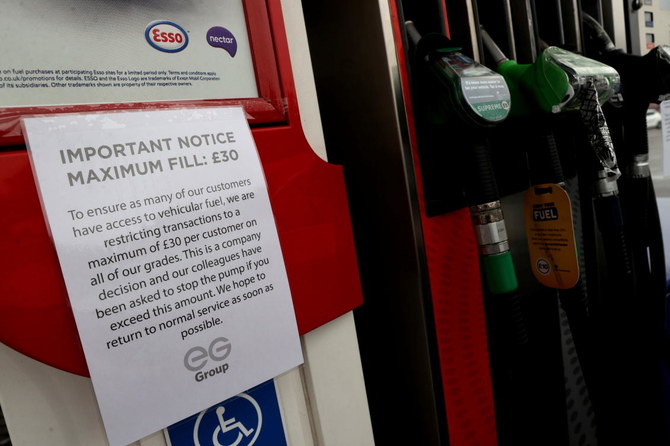

BP and Esso shut a handful of their stations in Britain this week because there were not enough truckers to get gas to the pumps. EG Group, which operates about 400 UK gas stations, said it was limiting purchases to 30 pounds ($41).

In a statement, the government said Britain had “ample fuel stocks.”

“But like countries around the world, we are suffering from a temporary COVID-related shortage of drivers needed to move supplies around the country,” it said, not acknowledging Brexit as a factor.

The head of the Confederation of British Industry, Tony Danker, said the driver shortage was in part “a Brexit hangover.”

“We had several drivers go home that we wouldn’t have wanted to go home, and I think there is this bigger question of the immigration system, and it’s a complicated one,” he told the BBC.

Danker said easing visa rules would be “a huge relief.”

“It’s a shame the government needed queues at the pumps to move, but move I hope they have, and it will help,” he said.

UK eyes visa change to ease trucker drought amid run on gas

Short Url

https://arab.news/46cag

UK eyes visa change to ease trucker drought amid run on gas

- Government said any action it took would be “very strictly time-limited”