RIYADH: OPEC secretary-general Mohammad Barkindo has died in Abuja, Nigeria at the age of 63, Arab News has learned.

He will be buried in his home town of Yola, a source confirmed.

The news of Barkindo’s death was confirmed by Mele Kyari, managing director of Nigerian National Petroleum Corporation.

Saudi Investment Minister Khalid Al-Falih paid tribute to Barkindo for his services and offered condolences to his family.

In a tweet, Kyari described Barkindo’s death as a great loss to his immediate family, NNPC Nigeria, the Organization of the Petroleum Exporting Countries, and the global energy community.

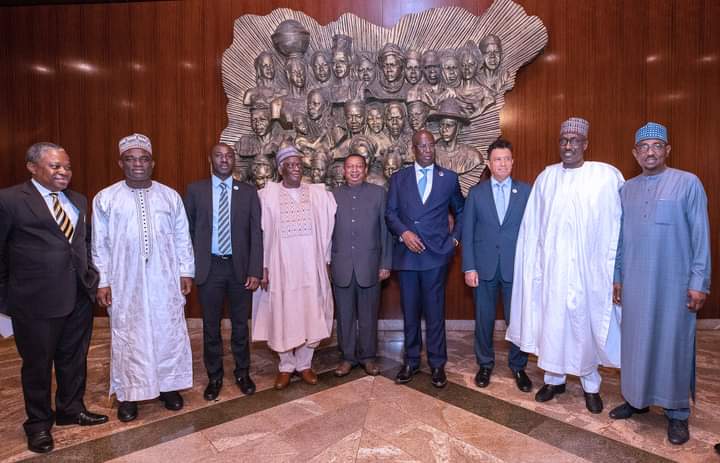

A few hours before his death, Barkindo was honored by Nigerian President Muhammadu Buhari at the state house.

During the ceremony, Buhari lauded Barkindo's efforts as the secretary general of OPEC for six years.

Opinion

This section contains relevant reference points, placed in (Opinion field)

“You have indeed been a worthy ambassador of our country. We are proud of your achievements before and during your appointment at OPEC and the proud legacies you will leave behind,” said Buhari.

Barkindo’s unexpected death came at a time when he was expected to complete his tenure as the OPEC secretary-general on July 31.

It has been reported that Barkindo would join the Atlantic Council as a distinguished fellow in the Global Energy Center after his term at the OPEC concluded.

In a career which spanned over four decades, Barkindo worked as NNPC’s International Investments head, president of Duke oil, and CEO of NNPC.

From 1986 to 2010, Barkindo was the Nigerian Delegate to OPEC Ministerial Conferences. He became the secretary-general of OPEC on Aug. 1, 2016, and continued in that position until his death.