JEDDAH: Saudi Arabia on Thursday unveiled a bold budget statement that outlines plans to increase spending in 2017 as well as measures designed to drastically cut the deficit.

The fiscal deficit is “now manageable” and is forecast at SR198 billion ($53 billion) next year, moving in the right direction as part of an aim to eliminate it altogether by 2020.

That is a decline of one third from the 2016 budget deficit of SR297 billion, itself 9 percent lower than originally forecast, and far below the high of SR366 billion seen in 2015, in the immediate fallout of the oil price crash.

King Salman approved the general budget for 2017 in a session of the Cabinet.

He underscored that the budget announcement comes amid economically volatile situations suffered by most states.

“Our economy is firm and it has sufficient strength to cope with the current economic and financial challenges and this is the result of the prudent fiscal policies taken by the state,” he said.

“We are determined to strengthen the elements of our national economy, where we adopted Saudi Vision 2030 and its programs according to a comprehensive reform plan that can transfer the Kingdom to broader and more comprehensive horizons to meet the challenges and strengthen its position in the global economy.”

The budget documents showed that the government had been able to finance the deficit by drawing from reserves and surpluses, in addition to borrowing SR200.1 billion on international debt markets.

The Saudi budget for 2017 reiterated the Kingdom’s aim to eliminate the fiscal deficit altogether by 2020. This is in line with the Kingdom’s Vision 2030 and related programs, including the National Transformation Plan.

The government plans to phase out its costly subsidies on energy, although low-income citizens will receive “direct cash support” to help them manage.

It will also introduce “minimal” fees on foreigners gradually up to 2020, the Saudi Finance Minister Mohammed Al-Jadaan told reporters in Riyadh.

“There are two kinds of fees, the first is according to the number of family members an expat has in return for utilities used… this minimal amount will increase gradually every year,” the minister said in response to a question from Arab News.

“The second is already imposed on companies which employ expat workers; this will increase gradually as well until 2020.”

The fees do not apply to domestic helpers, such as drivers and cleaners, but only to expats working in commercial entities, the minister said.

The finance minister ruled out income taxes on Saudi nationals, foreigners or company revenues.

The minister added that the Saudi government had paid all outstanding dues to private sector firms as the beginning of December. Any claims submitted in the last three weeks will be paid in two months’ time.

Al-Jadaan said that the budget figures published on Thursday included the cost of the Yemen war, adding that defending the country was vital no matter what the expenditure.

“There is no price tag (not worth paying) for defending our country, borders and people,” he said.

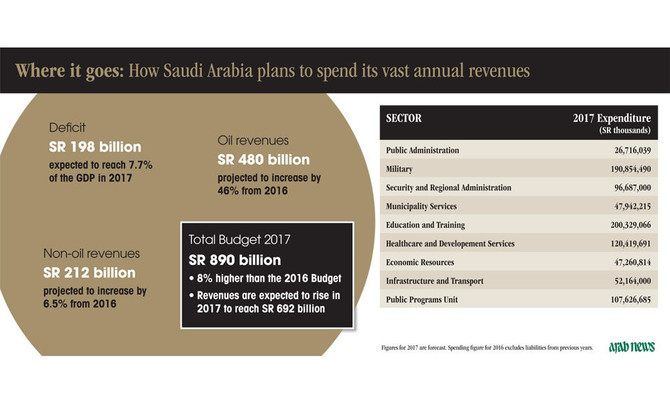

In 2016, Saudi Arabia’s total revenues are expected to reach SR528 billion, and are forecast to rise to SR692 billion next year. Oil revenues for 2017 are estimated at SR480 billion, 46 percent higher than the 2016 projections, while non-oil revenues are estimated at SR212 billion, a 6.5 percent increase.

Expenditure for 2016 stood at SR825 billion, excluding that related to the previous year, and less than the SR840 billion originally forecast. The expenditure in 2017 is estimated at SR890 billion, an 8 percent increase over 2016.

The total national debt for 2016 was approximately SR316.5 billion, which is 12.3 percent of the projected gross domestic product (GDP) in fixed prices for 2016. Official documents showed that the national debt will not exceed 30 percent of GDP.

“Following successful debt issuances in 2016, debt issuance will continue as and when needed, subject to local and international market conditions,” the budget documents said.

“The Kingdom will seek to raise further debt at attractive rates on international markets.”

This could include diversifying the type of issued debt by issuing Shariah-compliant instruments such as sukuk inside and outside the Kingdom.

Saudi budget slashes deficit forecast by a third

Saudi budget slashes deficit forecast by a third