With excitement building over the forthcoming royal wedding in Britain, it is easy to forget that Meghan Markle is not the first actress to bag a royal prince for a husband.

In 1955, 25-year-old American actress and film star Grace Kelly was at the height of her fame, with an Oscar to her name, when she was introduced to Prince Rainier of Monaco during the Cannes Film Festival.

They began writing to each other, and though they met only a few times, when Rainier proposed eight months later Kelly accepted.

In April 1956, the film star became Her Serene Highness Princess Grace of Monaco, with 140 other titles.

Their wedding in the tiny principality on the Mediterranean was watched by an estimated 30 million television viewers, perhaps the first “celebrity” event to command mass audiences.

The marriage was not entirely happy. It was said that she mourned the loss of her film career, and felt stifled by the limitations of royal life. In 1982, she was killed after she suffered a stroke while driving.

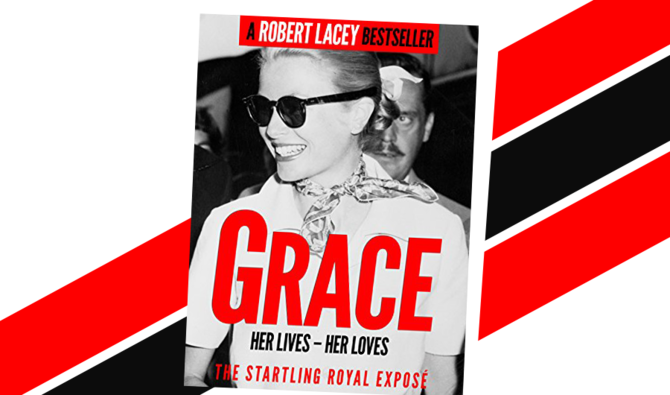

“Grace: Her Lives, Her Loves,” by respected royal historian Robert Lacey, is a well-researched and illuminating account of a woman who gave up acting but ended up playing the biggest role of her life.