RIYADH: Bangladesh is in talks with Saudi energy company ACWA Power to develop a large solar project which would supply Southeast Asian nations with one gigawatt of electricity as it shifts towards more clear energy sources, an official said.

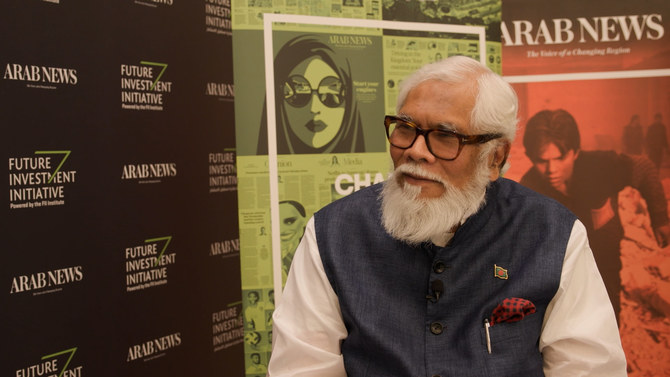

The country is also engaging in early talks with ACWA Power, in which the Saudi sovereign wealth fund PIF holds a 44-percent stake, about a potential green hydrogen project, Salman Fazlur Rahman, adviser to the Prime Minister, told Arab News.

“We've been talking with ACWA power for solar. In fact, ACWA power people were there in Bangladesh recently and they met our ministry of energy and they are negotiating a large solar project, a one gigawatt solar project. So, that's under negotiation,” he added. “We hope to conclude it soon and they will be signing an agreement pretty soon.”

Bangladesh has an installed capacity of 2.4 gigawatt, Rahman added, and the country needs more energy to expand the economy and to attract investors.

The drive for the hydrogen comes as a result of the country’s plan to establish a terminal to import liquefied natural gas (LNG). The same terminal can import green ammonia, which can be converted into green hydrogen.

“We are developing, with the Japanese government, a deep-sea port in Bangladesh where we are going to put an onshore LNG terminal and LPG terminal. So we are now thinking that this is the right time, because this is in the planning stage that we should also have an onshore ammonia terminal,” Rahman said.

ACWA Power is one of three partners in Saudi Arabia’s first green hydrogen project along with NEOM and US-based Air Products. The venture plans to export its first green ammonia project in early 2026 and it is looking for long-term off takers of the fuel.

“We are talking to ACWA power on green hydrogen as well, but that's a longer-term project because at the moment, even that technology is not perfected yet and the cost is still pretty high,” Rahman said.